- Construction Machinery: a field indispensable for development which used to be dominated by firms of advanced economies

- China’s rise as a major global construction machinery exporter in the past 20 years

- Emering and developing economies are major export destination of China’s construction machinery

- Promoting the Coordinated Development of Engineering Machinery Exports and RMB Trade Credit and Development Financing in Developing Countries

Note: This is an original piece by David Marx. Please cite according to Creative Commons 4.0 when sharing

Construction Machinery Exports, Developing Economies’ Markets, and the Internationalization of RMB

Construction machinery such as bulldozers, cranes, and drilling rigs are essential “heavy equipment” for infrastructure and industrial project construction. At the turn of the century, the global construction machinery market was dominated by developed country enterprises, with products from companies such as Caterpillar, Komatsu, and Liebherr filling markets around the world. Developing countries need to raise dollars and euros to import heavy industrial products produced by these companies for their construction projects.

However, over the past 20 years, the supply structure of the global construction machinery industry has undergone tremendous changes. Chinese companies such as Sany Heavy Industry, Xugong Group, Zoomlion Heavy Industry, and Liuzhou Group have grown rapidly, making China one of the world’s major exporters of construction machinery. In 2022, China’s global export share rose to 20%, surpassing Japan, the former No.1 exporter of construction machinery, for the first time.

Unlike consumer goods such as shoes, hats, and toys, which are mostly sold to advanced economies, Chinese construction machinery products are more popular in developing countries. Data shows that, in 2022, Chinese products accounted for 10.3% of imported construction machinery in developed countries, behind Japan and Germany. However, in emerging markets and developing countries (EMDCs), China’s share was 38.8%, higher than the sum of Japan, Germany, the United States, and South Korea. This “leaning towards developing economies” approach has achieved a win-win situation between China and EMDCs, which illustrates the solid foundation and potential of deepening cooperation within the Belt and Road Initiative framework.

Looking ahead, under the negative attitude of developed countries towards Chinese exports for high value-added products, further exploring developing country markets is still an important direction for China’s construction machinery exports. On the one hand, there are still some countries where China’s share is relatively low (such as Egypt and Chile); on the other hand, many developing countries are increasing their investment in infrastructure and the manufacturing sector, which are creating incremental demand for construction machinery.

The coordination of construction machinery export and RMB trade credit and developmental financing may help further ease the hard currency financing constraints of developing countries’ infrastructure investments. This will contribute to both developing countries’ sustainable development and China’s industrial upgrading.

I. Construction Machinery: a field indispensable for development which used to be dominated by firms of advanced economies

Construction and engineering machinery is indispensable equipment for achieving long-term economic growth. On the one hand, without machinery such as road rollers, bulldozers, and cranes, activities like bridge and road construction, building construction, and dam building would revert to relying on shovels and pickaxes. On the other hand, implementing industrial projects such as mineral extraction and oil and gas drilling would not be possible without excavators and drilling machines. Therefore, for developing countries, whether it’s infrastructure construction or industrialization through the utilization of natural resources, construction machinery is essential.

However, for developing countries, producing such machinery is not easy. First of all, engineering machinery is often structurally complex, and its design requires solving a series of theoretical and engineering problems, requiring rich experience accumulation. Secondly, casting machinery has high requirements for upstream components and materials, which need to meet high standards, and have a long service life. Finally, quality after-sale services such as maintenance are also highly valued by customers.

(Pictures are from the websites of Caterpillar and Komatsu)

For the above reasons, for a long time, construction machinery with good performance, long service life, and excellent after-sales service could only be provided by a few enterprises in developed countries, most of which are long-established players. For example, the two US giants, Caterpillar and John Deere, were founded in 1925 and in 1837, respectively, and the German start Liebherr was founded in 1949. In the late 20th century, Japanese companies in this field rose rapidly, represented by Komatsu and Hitachi, while firms in the Republic of Korea, such as Doosan, also entered the forefront of the world.

Therefore, at the turn of the century, developing countries would have to purchase a large amount of engineering machinery from developed countries for infrastructure and industrial investment. For economies that are still in the early stages of development and lack foreign exchange reserves, raising enough dollars to import machinery and equipment from abroad has become one of the hard constraints for project implementation.

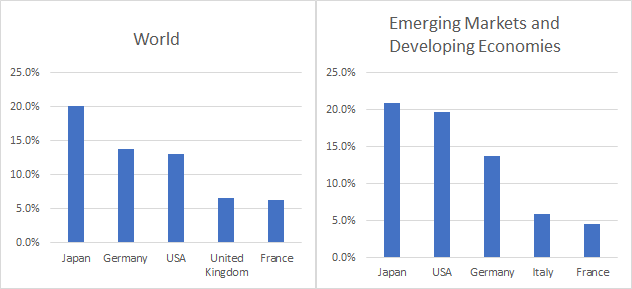

Trade data at the turn of the century supports the above views. Tabulation with the UN Comtrade data shows that, for the 21 HS 6 digit product categorized by China’s Ministry of Commerce as construction machinery 1, among the total global industrial machinery imports in 2002 of US$22.3 billion, 59.9% 2 were sourced from the top five exporters, which were Japan, Germany, the United States, the United Kingdom, and France. For emerging markets and developing economies, about 64.6% were sourced from their top five importers, which were Japan, the United States, Germany, Italy, and France.

Figure 1: Top five import souces of construction machinery in 2002: Global vs. EMDCs

Source: UN Comtrade Database; author’s calcualtion.

II. China’s rise as a major global construction machinery exporter in the past 20 years

Over the past 20 years, there has been a significant shift in the supply structure of the international engineering machinery market, led by the rapid growth of Chinese machinery enterprises.

At the beginning of the 21st century, it would have been hard to imagine China becoming a key player in this field, as it relied on Western machinery to a great extent. In 2002, China’s engineering machinery trade deficit reached $597 million, ranking the third globally, following Canada ($796 million) and Australia ($605 million).

(A Chinese construction tower in a project site in Dhaka, Bangladesh)

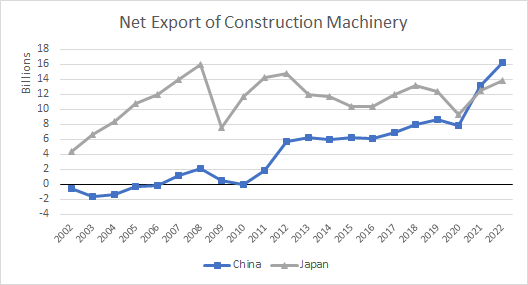

However, during this 20-year period, Chinese companies such as XCMG, Sany Heavy Industry, Zoomlion Heavy Industry Science & Technology, and Liugong Group experienced rapid growth. While firmly establishing themselves as leaders in the domestic market, they also began to make their mark on the international stage, contributing to China’s emergence as a global engineering machinery powerhouse. In 2007, China achieved a trade surplus in engineering machinery for the first time since the new century, and by 2021, it surpassed Japan to become the world’s largest net exporter of engineering machinery.

Figure 2: Net Export of Construction Machinery: China vs. Japan

Source: UN Comtrade Database; author’s calcualtion.

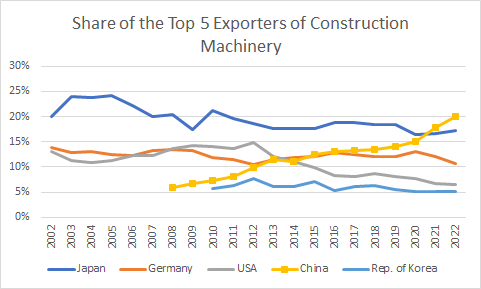

As for the gross export of construction machines, China became of the world’s top five exporters for the first time in 2008. It rose to third place in 2014, then second place in 2014, and finally claimed the top spot in 2021. In terms of global export share, China increased from 6.0% in 2008 to 20.0% in 2022. This sudden rise of China’s engineering machinery industry has had a significant impact on the existing landscape. The global export share of the United States declined from 13.6% in 2008 to 6.5% in 2022; during the same period, Germany’s share decreased from 13.4% to 10.7%, Japan’s from 20.3% to 17.3%, and South Korea’s from 5.7% to 5.2%.

Figure 3: Top 5 gross exporters of construction machinery in 2022 and their historical global shares

Note: missing data suggests the country was not among the world’s top five in respective years. Source: UN Comtrade Database; author’s calcualtion.

These figures demonstrate that China has firmly established itself as a major player in the engineering machinery industry, a field that has long been dominated by developed countries. Although emerging economies such as Brazil (ranked 7th globally in exports in 2022, with a 3.2% share), Thailand (14th, with a 1.6% share), India (18th, with a 1.3% share), Indonesia (19th, with a 0.9% share), and Turkey (20th, with a 0.8% share) also play a role in the global engineering machinery market, their export shares are relatively small, and their impact on competition among leading companies in the engineering machinery industry is limited.

III. Emering and developing economies are major export destination of China’s construction machinery

20 years ago, when China had just joined the World Trade Organization, its most well-known export products were consumer goods such as textiles, footwear, and toys. At that time, China possessed advantages in labor and land resources, and the majority of its consumer goods were flowing towards developed countries in Europe and America, which not only had higher incomes and a greater demand for consumer goods, but also held little domestic production capacity for those products.

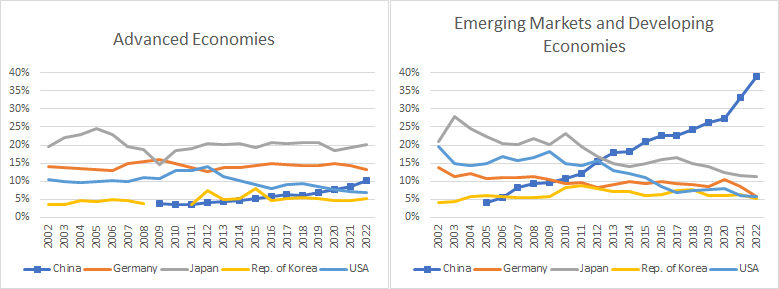

However, as technology- and capital-intensive products, it could be imagined that China’s construction machinery exports would have a hard time entering advanced economies. Construction and engineering machinery products are intricate and complex, and customers may care more for performance, lifespan, reliability, and after-sales service than prices. In addition, Europe and America are major producers of engineering machinery themselves, selling to their home countries would be displaying one’s skills beforea master craftsman.

The trade data again confirms the above view. In 2022, for advanced economies 3, China’s share of their construction machinery imports was merely 10.3%, ranking behind Japan (20.1%) and Germany (13.3%). In contrast, in emerging markets and developing countries, China’s share was 38.8%, ranking the 1st and was even larger than the next four combined.

Figure 4: Top 5 import sources of construction machinery: advanced economies and EMDCs

Note: missing data suggests the country was not among the world’s top five in respective years. Source: UN Comtrade Database; author’s calcualtion.

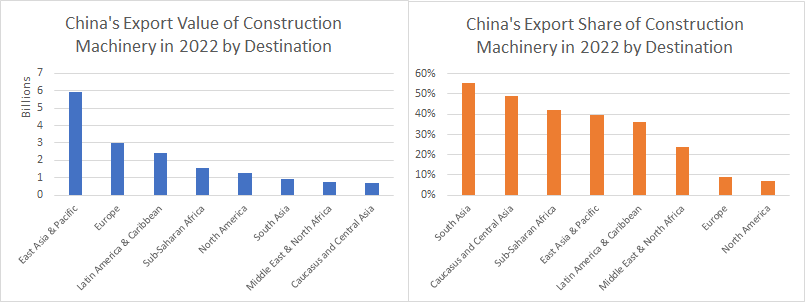

In terms of geographical distribution 4, China’s share was the highest in South Asian countries at 55.7%, followed by the Caucasus and Central Asia at 49.2%, and Southern Africa, the Asia-Pacific region, and Latin America (around 40%). For comparison, China’s share in Europe and North America was less than 10%.

Figure 6: Construction machinery sourced from China by regions: value and shares

Source: UN Comtrade Database; author’s calcualtion.

The following cases may help bring the aggregated numbers to reality, which lists where countries source their construction machinery imports in 2022:

- United States: 46% from Japan, 12% from Germany, only 7% from China;

- Canada: 47% from the United States, 22% from Japan, only 7% from China;

- France: 26% from Germany, 16% from Belgium, 10% from the Netherlands, only 1.6% from China (ranked 11th);

- Indonesia: 62% from China, 14% from Japan, 10% from Thailand;

- Mexico: 37% from China, 24% from the United States, 18% from Brazil;

- India: 58% from China, 7% from Japan, 6% from South Korea;

- Vietnam: 36% from China, 30% from Japan, 11% from South Korea;

- Brazil: 57% from China, 12% from the United States, 8% from Germany;

- Democratic Republic of the Congo: 67% from China, 6% from Finland, 4% from India.

Overall, the growth of China’s construction machinery industry has brought about a win-win situation for both China and a large number of developing countries. The reasons why developing countries purchase Chinese machinery equipment may vary—they may find the product performance excellent, cost-effective, with good after-sales service, or they may benefit from lower import credit rates. In a market with fierce competition from traditional Western alternative products, EMDCs’ calculated procurement choices indicate that they do benefit from buying Chinese machines. At the same time, for China, orders from developing countries allow them to gradually achieve internationalization and to learn and compete with Western peers, catalyzing China’s industrial upgrading.

This market-driven competition and win-win situation are the greatest charm of international trade.

IV. Promoting the Coordinated Development of Engineering Machinery Exports and RMB Trade Credit and Development Financing in Developing Countries

Further penetrating the European and North American markets is undoubtedly a crucial direction for the future efforts of Chinese engineering machinery enterprises. However, facing the current negative attitudes of Western countries towards Chinese exports of high-value-added goods, the related processes will not be smooth sailing. On one hand, as construction machinery undergoes digitalization and intelligent upgrades, developed countries’ concerns about engineering data security may be used to restrict the use of Chinese products. On the other hand, protecting their own leading enterprises will also become an important policy objective.

Therefore, further tapping into the international market base of developing countries for China’s will be foundational. There are still many markets in developing countries with relatively low presence of Chinese machinery products. Examples are Egypt, where China accounted for only 10% of engineering machinery imports in 2022, lagging behind the United States, Belgium, and Germany, and Chile, where China accounted for 20% in 2022, trailing behind the United States’ 25%.

Meanwhile, developing economies have huge unrealized demand for infrastructure investment and industrial upgrading, which are currently capped by factors such as insufficient financing and inadequate project design capabilities. Should those constraints ease, a large increment in demand will be generated for construction machinery. This will bring new opportunities for Chinese enterprises.

RMB trade credit and developmental financing have the potential to play a significant driving role. For projects in developing countries that can generate stable cash flow and contribute to enhancing their export capabilities, such as mineral development and processing industrial projects, as well as transportation projects such as ports and connecting railways and highways, Chinese banks and policy financial institutions can provide low-interest RMB import credits or developmental financing. The project entities may use the relevant funds to purchase Chinese machinery for project construction, and then repay the loans by exporting to China or other countries.

This links the functions of RMB as an international currency in trade and financing, promotes the sustainable development of the host country, and drives the export of Chinese construction machinery products. According to calculations by Eichengreen et al. 5, as of 2017, the proportion of RMB funds in China’s outward development financing was only 6%, indicating that there is still significant room to further enhance the use RMB in machinery exports and development financing.

Footnotes:

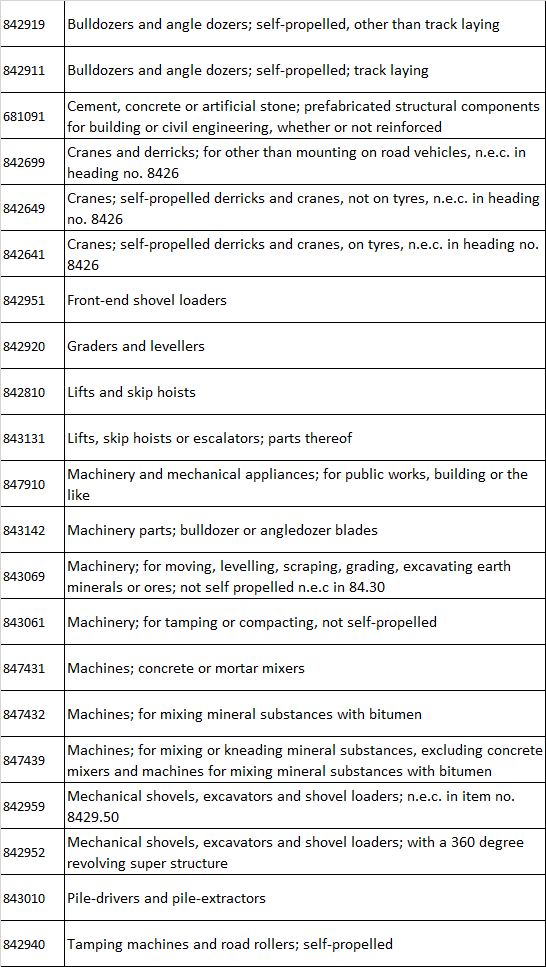

Appendix: The 21 HS 6 Digit Items covered by the calculation of Construction Machinery

-

See the “Export Commodity Technical Guide: Engineering Machinery Products” Table 1.1 from the Ministry of Commerce of China (“Customs Classification and Commodity Names of Engineering Products”). The table lists 32 HS8 code items, including excavating machinery, earthmoving machinery, road construction machinery, engineering lifting machinery, compaction machinery, pile-driving machinery, concrete machinery, and steel reinforcement and prestressing machinery. As cross-border trade data analysis requires the use of the UN Comtrade Database, which only provides HS6 code data, the author extracted the 21 HS6 codes corresponding to these 32 HS8 codes (see Appendix) to obtain import data for these codes from various countries worldwide, to measure global engineering machinery import trade. Unlike general statistics based on HS4 code classification, the scope of engineering machinery trade products selected in this article is narrower, so the trade amount may be lower than in other studies. ↩

-

Calculated from import data from various countries to obtain the import sources and corresponding amounts of engineering machinery products from each country, and then calculated the proportion of each source country by adding them up according to the import source. Therefore, this proportion is calculated based on CIF. ↩

-

Calculated according to the country classification in the International Monetary Fund’s World Economic Outlook Database (October 2023). Combined with the countries and regions reporting engineering machinery import data in the trade database, the “Advanced Economies” in this study cover 38 countries and regions such as the United States and the Euro area, while “Emerging Markets and Developing Economies” cover 139 economies including China and India. There are also 12 economies that do not correspond to the above classification, with their industrial machinery trade accounting for no more than 1.2% of the global total. ↩

-

The regional classification mainly follows the World Bank’s classification standards but divides “Europe and Central Asia” into “Europe” and “Caucasus and Central Asia,” with the latter including eight countries: Afghanistan, Armenia, Georgia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. ↩

-

Is Capital Account Convertibility Required for the Renminbi to Acquire Reserve Currency Status?, https://www.banque-france.fr/en/publications-and-statistics/publications/capital-account-convertibility-required-renminbi-acquire#:~:text=It is widely assumed that the renminbi (RMB),currency in the absence of capital account convertibility. ↩