Summary

-

The determination of tariff levels is based on the relative magnitude of trade deficits rather than equivalence in tax rate terms.

-

Under the USTR’s ideal assumptions, economies such as China, India, South Africa, Bangladesh, and Indonesia would face higher impacts, with estimated effects ranging from 0.5% to 1% of GDP.

-

For China specifically, if the current tariffs replace those imposed during Trump’s first term, the net impact would effectively be around 15%. Combined with the 20% tariffs imposed in February under the pretext of “fentanyl controls”, the new tariffs during Trump’s second term so far would be approximately 35%. China retains sufficient economic policy space to safeguard growth.

-

While the U.S. represents a major market, BRICS nations collectively form another significant market, making this an opportune moment to deepen financial and economic cooperation among themselves.

“Reciprocity”, really?

This round of tariffs, under the guise of “reciprocity”, is actually just an excuse to impose different tariffs on different trade partners.

According to the explanation on the White House website, tariffs are not calculated based on the tariffs imposed by trade partners on the United States, but on the relative size of the United States’ trade deficit with each partner. Specifically, the relative deficit is defined as US trade deficit against a partner divided by US exports to that partner.

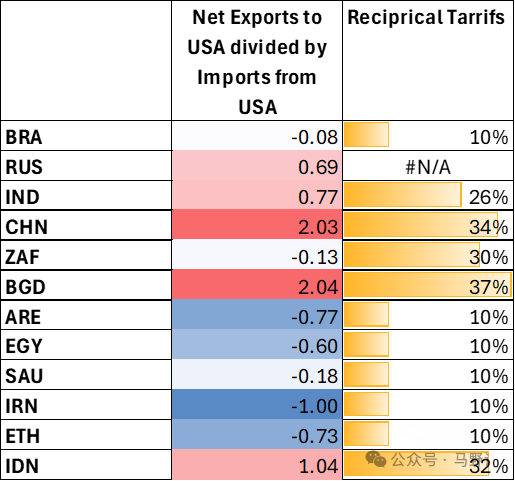

Figure 1 shows the tariffs imposed on a few BRICS countries (the second column), with the first column indicating the relative size of trade surplus with the United States.

Countries such as China (CHN), Bangladesh (BGD), and Indonesia (IDN) with a relative surplus greater than 1 are taxed at rates of more than 30%.

Although India’s absolute deficit is larger than Indonesia’s (330 million in 2023 vs.120 million), its relative deficit is smaller (i.e., its imports from the United States are larger), so its tariffs are correspondingly lower.

(Note: Based on IMF DOTS for Year 2023; South Africa’s deficits against US in 2023 is a one-time exception; no tariff rates were announced for Russia.)

What are the impacts?

The impact of tariffs depends not only on the tariff rate itself, but also on the extent to which countries trade with the United States and their economic dependence on trade.

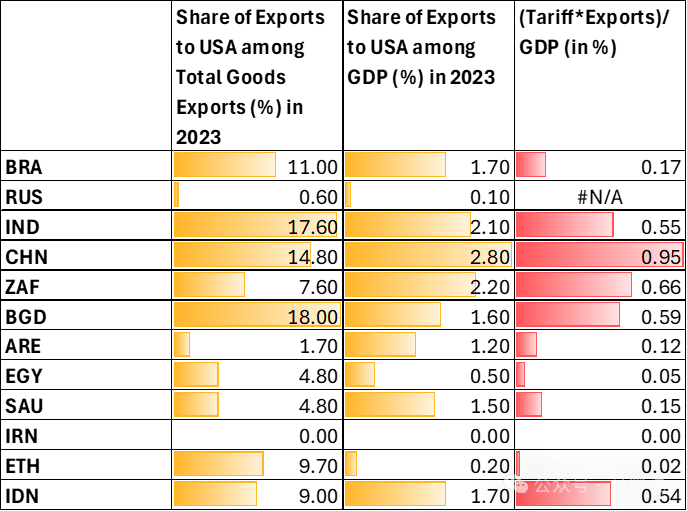

The first column of Figure 2 shows selected economies’ export proportion to the United States. India and Bangladesh have a larger risk exposure as their exports to the United States account for more than 15% of their total goods exports. China is next, followed by Brazil (BRA), Ethiopia (ETH), and Indonesia, which are around 10%.

The second column shows the ratio of exports to the United States to a country’s GDP. For this measure, China, India, and South Africa exceed 2%, while Brazil, Bangladesh, Saudi Arabia (SAU), and Indonesia are around 1.7%; Egypt (EGY) and Ethiopia are even lower.

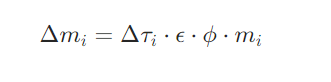

According to the USTR explanation, the impact of tariffs on countries’ exports to the United States is represented by the following equation:

where the first to fourth terms on the right side respectively represent changes in tariff rates, impacts of tariffs on export prices, impacts of export prices on export volumes, and current export volumes to the US.

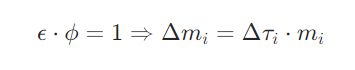

The USTR assumes that the product of the second and third terms is 1, so in fact it expects the impact of tariff hikes on exports to the US as the product of the tariff rate change and export volume:

I would not discuss the amusement this caliberation raises here. Rather, I would assume that the USTR’s parameter selection is reasonable to quantify the impact by calculating reduction in exports to the United States as a percentage of GDP.

The results are shown in the third column of the above figure. Under this measurement, the GDP of China, India, South Africa, Bangladesh, and Indonesia will decrease by about 0.5 to 1 percentage point.

This could be an extreme situation. In reality, exchange rates may shift, and imports from the United States may also decline, which could reduce the actual impact. Of course this calculation does not include general equilibrium effects, such as the impact on investment and consumption, as were the assumption of the White House.

Ambiguity on China

The US has already hiked tariffs on China during the first term of Trump. Analysis show (e.g., this PIIE chart)that those amounts to about an average tariffs about 20%, on about two-thirds of products. During the Biden administration, new tariffs were added ti products such as solar, battery, EV, and others.

If this round of the “reciprical” rate of 34% acts as a substitute for the above-mentioned rates, then the actual tax rate increase is about 15%-20%. Coupled with the 20% tariff hike in February under the pretext of “fentanyl”, the actual tax rate increase so far in Trump’s second term is around 35%-40% (rather than 54%).

If this assumption holds, the overall economic impact should be about 0.8 percentage points of GDP.

Given China’s fiscal support announced in March 2025 (the increase of General Public Deficit from 3% of GDP to 4%, and the rise of extended deficit ratio from 8% of GDP to 10%), as well as “an abundance of reserved policies” announced by Premier Li Qiang in late March, China is likely to be abel to safeguard its economy during this round of shocks.

The U.S. Market Matters, but the World Extends Beyond America

For BRICS nations, the United States remains an important market, but it is not the entirety.

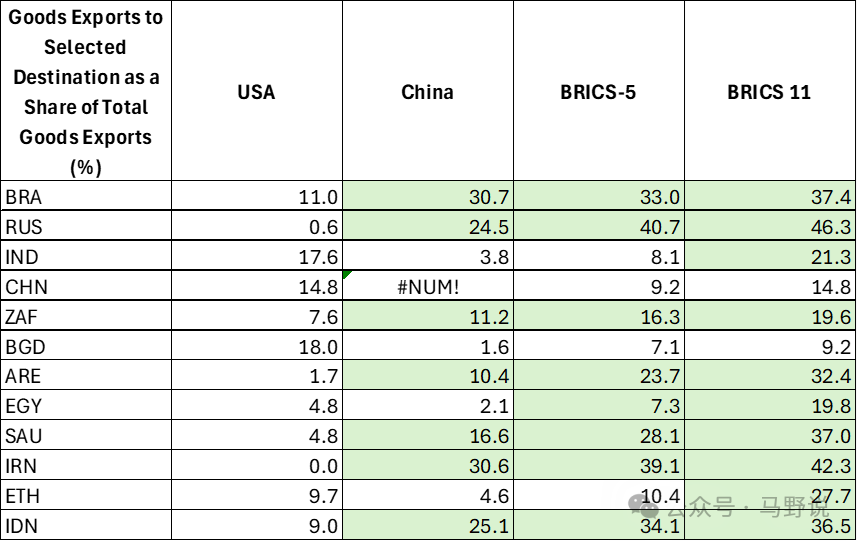

The four columns of data in the figure below represent the proportion of each country’s exports to the US in 2023 as a share of total goods exports, comparing them to the export shares destined to China, BRICS-5, and BRICS-11.

(Note: green shares in the last three column indicate values higher than the respective ones in the first.)

The calculation reveals that for countries like Brazil (BRA), Russia (RUS), Saudi Arabia (SAU), and Indonesia (IDN), China has already become a much larger export market than the United States. Even for India (IND) and Ethiopia (ETH), where US act as a major export market, BRICS-11 together are an equally important dedtination.

Economic cooperation among BRICS nations is now more critical than ever. The vast potential of BRICS cooperation offers immense opportunities for collective progress!